Understanding Reversal Strategies in Trading | A Comprehensive Guide

In the dynamic world of financial markets, understanding and implementing effective trading strategies is paramount to success. Among the plethora of approaches, reversal strategies stand out as a popular and potentially profitable method. This blog post will delve into what reversal strategies are, why they are important, how to identify potential reversals, and some common techniques used by traders.

What are Reversal Strategies?

At its core, a reversal strategy aims to profit from a change in the prevailing market trend. Instead of trading with the trend (which is what trend-following strategies do), reversal traders attempt to identify points where an asset's price direction is about to reverse – either from an uptrend to a downtrend, or vice versa. This can involve catching the very top of a bullish run or the very bottom of a bearish decline.

Why are Reversal Strategies Important?

Reversal strategies, when executed correctly, can offer several advantages:

- High Reward-to-Risk Ratio: If a reversal is accurately identified near its turning point, the potential profit can be substantial relative to the initial risk.

- Early Entry/Exit: Reversal traders aim to enter trades early in a new trend, potentially capturing a significant portion of the subsequent price movement. Similarly, they can exit existing trades before a major trend change erodes profits.

- Diversification: Incorporating reversal strategies can diversify a trading portfolio, providing opportunities even in choppy or range-bound markets where trend-following might be less effective.

Identifying Potential Reversals: Key Indicators and Concepts

Successfully implementing a reversal strategy hinges on the ability to accurately identify potential turning points. This requires a combination of technical analysis, understanding market sentiment, and sometimes even fundamental analysis. Here are some key indicators and concepts to consider:

-

Price Action Analysis:

- Candlestick Patterns: Specific candlestick formations often signal potential reversals. Examples include:

- Engulfing Patterns (Bullish/Bearish): A large candle that completely "engulfs" the previous candle, indicating a strong shift in momentum.

- Hammer/Inverted Hammer (Bullish): Small body with a long lower/upper wick, suggesting buying/selling pressure at the lows/highs.

- Doji: A candle with a very small real body, indicating indecision in the market, often appearing at turning points.

- Morning Star/Evening Star: Multi-candlestick patterns that signal a bullish/bearish reversal.

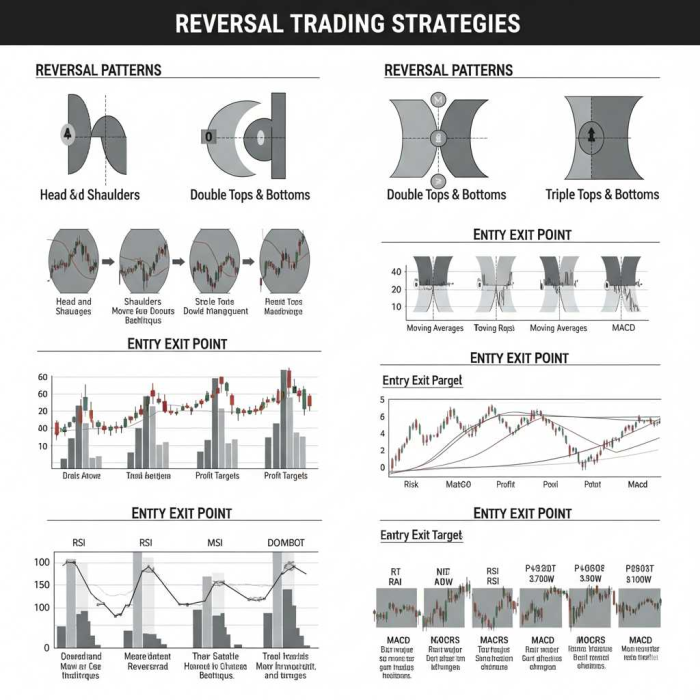

- Chart Patterns: Larger price formations can also indicate reversals:

- Double Top/Bottom: Suggests a failed attempt to break higher/lower, often leading to a reversal.

- Head and Shoulders/Inverse Head and Shoulders: A classic reversal pattern.

- Wedges (Rising/Falling): Can signal a potential reversal once the price breaks out of the wedge.

- Candlestick Patterns: Specific candlestick formations often signal potential reversals. Examples include:

-

Volume Analysis:

- Divergence: If prices are making new highs but volume is declining, it can indicate a weakening of the trend and a potential reversal. Conversely, increasing volume during a sharp price move against the trend can signal a strong reversal.

- Spikes in Volume: Unusually high volume at key resistance or support levels can often accompany a reversal.

-

Technical Indicators:

- Oscillators (RSI, Stochastic Oscillator, MACD): These indicators can help identify overbought or oversold conditions, which often precede a reversal.

- Divergence: When the price makes a new high/low, but the oscillator fails to do so, it's a strong signal of weakening momentum and potential reversal.

- Crosses: MACD crossovers can signal shifts in momentum.

- Support and Resistance Levels: Strong support or resistance zones are common areas for price reversals. When price approaches these levels and shows signs of faltering, a reversal becomes more likely.

- Oscillators (RSI, Stochastic Oscillator, MACD): These indicators can help identify overbought or oversold conditions, which often precede a reversal.

-

Market Sentiment and News:

- Extreme Sentiment: When market sentiment reaches extreme bullishness or bearishness, it often precedes a reversal.

- Major News Events: Unexpected news or economic data releases can trigger sharp reversals as market participants adjust their positions.

Common Reversal Trading Techniques

While the identification of reversals is crucial, the execution of the trade also requires a defined strategy. Here are a few common approaches:

- Breakout Confirmation: Instead of entering precisely at the turning point, some traders wait for a clear breakout from a reversal pattern or a key support/resistance level to confirm the new trend.

- Retest Entry: After a reversal, price often retests the broken support/resistance level before continuing in the new direction. Traders can enter on this retest for a more confirmed entry.

- Fibonacci Retracements: After an initial reversal move, traders can use Fibonacci retracement levels to identify potential entry points for a continuation of the new trend.

- Combining Indicators: The most effective reversal strategies often involve combining multiple indicators and analytical techniques to increase the probability of a successful trade. For example, a bearish engulfing pattern on high volume at a resistance level, combined with RSI divergence, would be a strong reversal signal.

Risks and Considerations

While potentially profitable, reversal strategies are not without risks:

- False Signals: Reversal signals can be misleading, and prices may resume the original trend, leading to losses.

- Whipsaws: Markets can be volatile, leading to frequent reversals that quickly turn back, resulting in multiple small losses.

- Difficulty in Timing: Accurately timing market reversals is incredibly challenging, even for experienced traders.

- High Risk-Reward Ratio: While the potential reward is high, the initial risk needs to be managed carefully with strict stop-loss orders.

Conclusion

Reversal strategies offer an exciting and potentially lucrative approach to trading. By understanding the underlying principles, mastering technical analysis, and diligently managing risk, traders can enhance their ability to identify and capitalize on market turning points. However, it's crucial to remember that no strategy guarantees success, and continuous learning, practice, and adaptation are key to navigating the ever-evolving financial markets. Always start with a robust trading plan, rigorous risk management, and a thorough understanding of the assets you are trading.

Popular Tags