Order Flow Trading (Advanced) |Unlocking the Market's Hidden Language

For many traders, price charts and conventional indicators are the extent of their market analysis. They see where price has been and try to guess where it's going next. But what if you could see the why behind the move? What if you could peer into the real-time battle between buyers and sellers, anticipating institutional actions and gauging true market sentiment before it's reflected on a lagging chart?

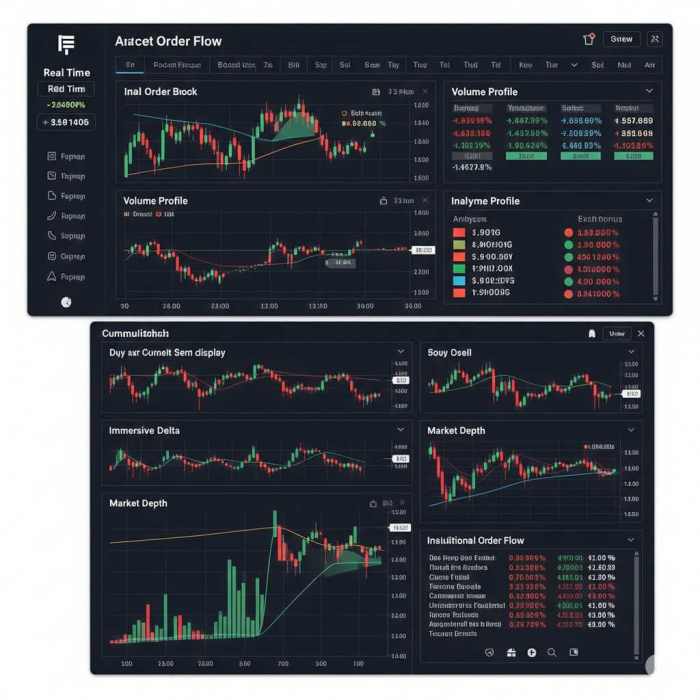

Welcome to the world of advanced Order Flow Trading. This isn't about chasing fleeting signals; it's about understanding the very mechanics of the market – the actual buying and selling pressure that drives every tick.

Beyond the Basics: What is Advanced Order Flow?

At its core, order flow trading analyzes the flow of buy and sell orders in real-time. While basic order flow introduces concepts like the Depth of Market (DOM) and Time & Sales, advanced order flow delves into the nuances, subtleties, and hidden intentions of market participants. It's about translating raw market data into actionable insights, giving you an unparalleled edge.

Here's what advanced order flow unpacks:

- The Order Book and Depth of Market (DOM) in Detail: It's not just about seeing bids and asks; it's about understanding how liquidity is being added, pulled, and absorbed. Advanced traders read the "iceberg" orders – large institutional orders broken into smaller chunks to conceal their true size – and understand their impact on price.

- Footprint Charts: The X-Ray Vision: Forget simple candlesticks. Footprint charts dissect each bar, showing you the volume traded at each price level, broken down by aggressive buyers and sellers. This allows you to identify imbalances, absorption patterns, and exhaustion points with pinpoint accuracy.

- Volume Profile: Unmasking Value Areas: The Volume Profile visualizes the distribution of traded volume across price levels over a given period. Advanced order flow traders use this to identify high-volume nodes (HVNs) – where significant activity has occurred, often acting as strong support/resistance – and low-volume nodes (LVNs) – areas where price tends to move quickly due to a lack of interest.

- Cumulative Delta: Gauging True Momentum: Cumulative Delta tracks the net difference between buying and selling volume over time. It can reveal hidden divergences from price action, signaling potential reversals or continuations that conventional indicators might miss.

- Microstructure Analysis: This is where things get truly granular. Advanced traders study how orders are placed, canceled, and executed in milliseconds, looking for subtle patterns and anomalies that indicate manipulative tactics or institutional positioning.

Advanced Order Flow Strategies: The Playbook of the Pros

Once you grasp the foundational concepts, advanced order flow allows for the implementation of sophisticated strategies:

- Absorption Trading: This powerful strategy identifies instances where large aggressive orders are "absorbed" by passive limit orders on the opposite side without significant price movement. This indicates strong conviction from the absorbing party (often institutional players) and can signal a potential reversal or the end of a price run.

- Iceberg Order Detection: Learning to spot these camouflaged orders provides a significant advantage. If a large iceberg buy order is present, it suggests underlying demand that could support price, while a large iceberg sell order indicates supply that might cap a rally. Traders can front-run these orders to capitalize on anticipated moves.

- Exhaustion Patterns: Advanced order flow helps you pinpoint when buying or selling pressure is truly exhausted. This goes beyond just fading volume; it involves observing the nature of the orders, their size, and their inability to push price further, often leading to sharp reversals.

- Liquidity Grabs and Stop Hunts: Understanding where liquidity is resting (e.g., stop-loss clusters) allows advanced traders to anticipate "stop runs" – intentional pushes by large players to trigger those stops and create liquidity for their own positions. Identifying these can help you avoid being trapped or even profit from the ensuing move.

- Market Imbalance Trading: While basic imbalance identifies disparities between bids and asks, advanced analysis examines the context of these imbalances. Is it an initiative move or simply an opportunistic trade? Understanding the aggressor's intent is key.

- Combining with Market Profile: Integrating order flow with Market Profile allows for a holistic view. Market Profile identifies value areas and overall market structure, while order flow provides real-time validation and precise entry/exit points within that structure.

Why Go Advanced? The Competitive Edge

In today's algorithmic-driven markets, relying solely on lagging indicators is akin to driving by looking only in the rearview mirror. Advanced order flow offers:

- Real-time Insights: You see the market as it unfolds, not after the fact. This allows for proactive decision-making.

- Precision Entries and Exits: By understanding the exact levels where buying and selling pressure is occurring, you can fine-tune your entries and exits, potentially reducing drawdowns and maximizing profits.

- Unmasking Institutional Activity: Order flow provides a window into the actions of large market participants, helping you trade alongside them rather than against them.

- Enhanced Risk Management: Identifying areas of strong support and resistance based on real order activity helps you place more intelligent stop-losses and manage your positions more effectively.

- Improved Confidence: When you understand why the market is moving, your conviction in your trades grows, leading to more disciplined and profitable trading.

The Journey to Mastery

Advanced order flow trading is not a quick fix. It requires dedicated study, consistent practice, and the right tools (specialized software like Bookmap, Jigsaw Trading, or ATAS are often essential). It's a journey of continuous learning, but for those willing to put in the effort, it offers an unparalleled depth of understanding and a significant competitive advantage in the financial markets.

Are you ready to stop guessing and start seeing the market's true intentions? The world of advanced order flow trading awaits.

Popular Tags