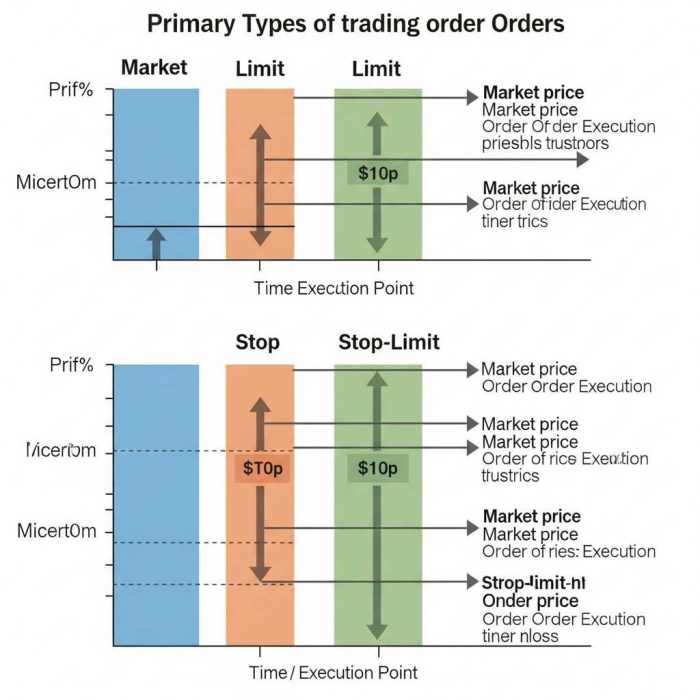

Navigating the Order Book | Market, Limit, Stop, and Stop-Limit Orders Explained

Imagine you're at a vibrant marketplace. You want to buy a specific item, but how do you ensure you get the best deal, or that your purchase happens at all? The stock market, in essence, operates similarly, and your "buying instructions" are the order types you choose.

1. The Market Order: Speed Over Price

A Market Order is the simplest and most immediate order type. When you place a market order to buy or sell an asset, you are essentially telling your broker: "Execute this trade right now, at the best available price."

- How it works: Your order will be filled almost instantly at the prevailing market price. For a buy order, it will execute at the lowest available ask price; for a sell order, it will execute at the highest available bid price.

- Pros: Guaranteed execution (as long as there's liquidity). Ideal for situations where speed is paramount and you need to enter or exit a position immediately.

- Cons: No price control. The execution price can fluctuate rapidly in volatile markets, potentially leading to "slippage" – meaning your actual fill price might be slightly different (and less favorable) than what you saw just moments before.

- When to use: When you absolutely need to get into or out of a trade and are willing to accept the current market price, regardless of small fluctuations.

2. The Limit Order: Price Control is King

A Limit Order allows you to specify the maximum price you're willing to pay for a buy order or the minimum price you're willing to accept for a sell order.

- How it works:

- Buy Limit Order: You set a price below the current market price. Your order will only execute if the asset's price drops to or below your specified limit.

- Sell Limit Order: You set a price above the current market price. Your order will only execute if the asset's price rises to or above your specified limit.

- Pros: Precise price control. You avoid unfavorable slippage and can potentially buy lower or sell higher.

- Cons: No guarantee of execution. If the market never reaches your specified limit price, your order will not be filled. You might miss out on a trading opportunity.

- When to use: When you have a specific price target in mind and are patient enough to wait for the market to reach it. Excellent for disciplined entry and exit strategies.

3. The Stop Order (also known as a Stop-Loss Order): Protecting Your Capital

A Stop Order is primarily used for risk management, often referred to as a stop-loss order. It becomes a market order once a specified "stop price" is reached or breached.

- How it works:

- Sell Stop Order: You set a stop price below the current market price. If the asset's price falls to or below this stop price, your stop order is triggered and automatically becomes a market order to sell.

- Buy Stop Order: (Less common, but used for buying back short positions or entering trades on a breakout) You set a stop price above the current market price. If the asset's price rises to or above this stop price, your stop order is triggered and automatically becomes a market order to buy.

- Pros: Limits potential losses on an existing position. Automates your exit strategy, removing emotional decision-making. Can be used to protect profits by moving your stop price up as the asset's price increases (trailing stop).

- Cons: Can be subject to slippage, especially in fast-moving markets, meaning your actual execution price might be worse than your stop price. A sudden market drop could trigger your stop, only for the price to recover shortly after.

- When to use: Essential for managing risk and protecting capital. Always consider placing a stop-loss order when entering a trade.

4. The Stop-Limit Order: The Best of Both Worlds?

A Stop-Limit Order combines features of both stop and limit orders, offering more control over the execution price once your stop is triggered.

- How it works:

- You set two prices: a stop price and a limit price.

- When the asset's price reaches or breaches your stop price, the order is triggered, but instead of becoming a market order, it becomes a limit order at your specified limit price.

- Pros: Offers more price control than a regular stop order, mitigating slippage risk. You won't get filled at a price worse than your limit.

- Cons: No guarantee of execution. If the market moves too quickly past your limit price after the stop is triggered, your order might not be filled. You could still experience a significant loss if the price drops rapidly and never recovers to your limit.

- When to use: When you want the protection of a stop order but also want to avoid significant slippage. Ideal for less volatile markets or when you have a specific maximum loss you're willing to accept.

Choosing the Right Order Type for You

The best order type depends entirely on your trading goals, risk tolerance, and market conditions.

- For immediate execution: Use a Market Order.

- For price control and patience: Use a Limit Order.

- For risk management and loss prevention: Use a Stop Order.

- For controlled risk management with price protection: Use a Stop-Limit Order.

Understanding and strategically employing these four fundamental order types will empower you to execute trades with greater precision, manage your risk more effectively, and ultimately, navigate the dynamic world of financial markets with increased confidence. Happy trading!

Popular Tags