What Makes a Currency Tick? Understanding the Forces Behind Exchange Rates

Have you ever wondered why the price of the US Dollar against the Euro changes every day, or why a vacation to Japan suddenly seems more affordable? The world of currency exchange rates can feel like a mysterious beast, constantly fluctuating and impacting everything from global trade to your travel budget. But it's not magic; it's a complex interplay of economic fundamentals, market sentiment, and even geopolitical shifts.

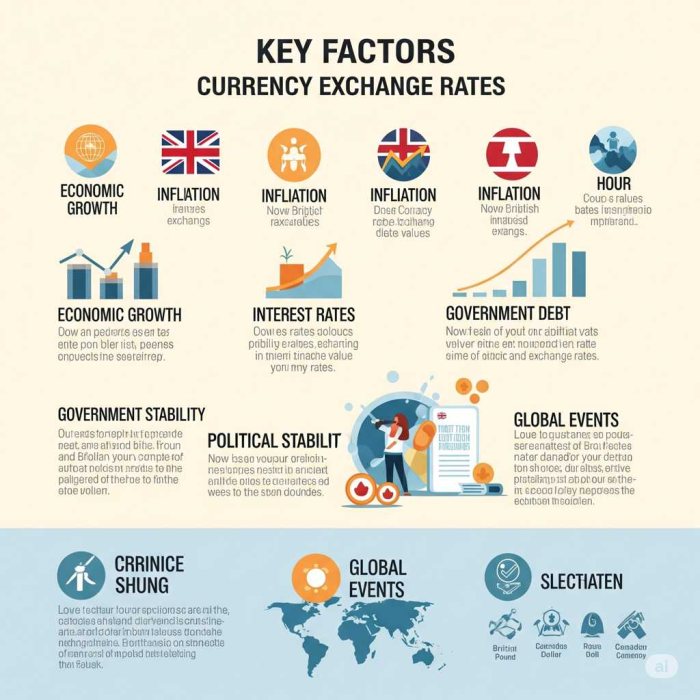

So, what exactly affects currency prices? Let's break down the key drivers:

1. Interest Rates: The Central Bank's Lever

One of the most powerful tools a country's central bank (like the Federal Reserve in the US or the European Central Bank) has is setting interest rates.

- Higher interest rates generally make a country's currency more attractive to foreign investors. Why? Because they can earn a higher return on their investments (like bonds) denominated in that currency. Increased demand for the currency pushes its value up.

- Lower interest rates have the opposite effect, making the currency less appealing to foreign capital, thus potentially weakening its value.

Think of it like this: if you can get a better return on your savings in one country versus another, you're more likely to put your money there, right? Currencies work in a similar way.

2. Inflation: The Purchasing Power Erosion

Inflation refers to the rate at which the general prices for goods and services are rising, effectively eroding the purchasing power of a currency.

- Low and stable inflation is generally seen as a positive for a currency. It means the currency is retaining its value over time, making it more desirable.

- High inflation, on the other hand, devalues a currency. If your money buys less today than it did yesterday, its appeal diminishes, leading to depreciation. Central banks often raise interest rates to combat high inflation, creating a direct link between the two.

3. Economic Performance and Growth: The Health Report

A country's overall economic health is a major determinant of its currency's strength. Key indicators include:

- Gross Domestic Product (GDP): Strong GDP growth signals a healthy, expanding economy, which tends to attract foreign investment and boost the currency's value.

- Employment Data Low unemployment rates indicate a robust labor market and a thriving economy, which can strengthen a currency.

- Industrial Production and Consumer Confidence: Positive trends in these areas generally point to a strong economy and a more appealing currency.

Investors are drawn to economies that are growing and stable, as these offer better prospects for returns.

4. Trade Balances: The Export-Import Equation

The trade balance measures the difference between a country's exports (goods and services sold to other countries) and its imports (goods and services bought from other countries).

- A trade surplus (exports exceed imports) generally leads to a stronger currency. When a country sells more to the world, there's a higher demand for its currency to pay for those goods and services.

- A trade deficit (imports exceed exports) often puts downward pressure on a currency. The country needs to sell more of its own currency to buy foreign goods, increasing supply and potentially lowering its value.

5. Government Debt: The Fiscal Burden

A country's level of public debt can significantly influence its currency.

- High levels of government debt can be a cause for concern for investors. It suggests that the government might need to print more money to service the debt, which can lead to inflation and currency devaluation. It also raises questions about the country's fiscal stability, potentially deterring foreign investment.

- Lower debt levels generally indicate a more financially sound nation, which can enhance investor confidence and support currency strength.

6. Political Stability and Geopolitical Events: The Wildcards

While economic fundamentals are crucial, the world of currency is also heavily influenced by political landscapes and unexpected events.

- Political Stability: Investors prefer countries with stable political systems. Uncertainty, political unrest, or frequent changes in government can scare off investors, leading to currency depreciation.

- Geopolitical Events: Wars, trade disputes, natural disasters, or global crises can create significant volatility in currency markets. These events can disrupt economies, shift investor sentiment, and prompt a flight to "safe-haven" currencies (like the US Dollar or Swiss Franc) during times of uncertainty.

7. Market Sentiment and Speculation: The Human Factor

Finally, it's important to remember that currency markets are driven by human participants.

- Market sentiment refers to the overall attitude of investors towards a particular currency or market. If sentiment is positive, demand for the currency can increase, driving up its price.

- Speculation plays a significant role, as traders buy or sell currencies based on their anticipation of future events or economic developments. Large speculative flows can cause short-term fluctuations, even if underlying economic conditions haven't changed dramatically.

In Conclusion:

Understanding what affects currency prices is crucial for anyone involved in international trade, investing, or even planning a trip abroad. It's a dynamic and interconnected system where economic data, central bank policies, political stability, and even human psychology all play a part. By keeping an eye on these key factors, you can gain a better appreciation for the fascinating world of foreign exchange and make more informed decisions.

Popular Tags