Navigating the Global Maze| A Look at Forex Regulation Around the World

The foreign exchange (Forex) market, a colossal and perpetually active global marketplace, facilitates trillions of dollars in currency trades daily. Unlike traditional stock exchanges with central governing bodies, Forex operates as an over-the-counter (OTC) market, meaning transactions occur directly between participants. This decentralized nature makes robust regulation absolutely crucial for safeguarding investors and ensuring market integrity.

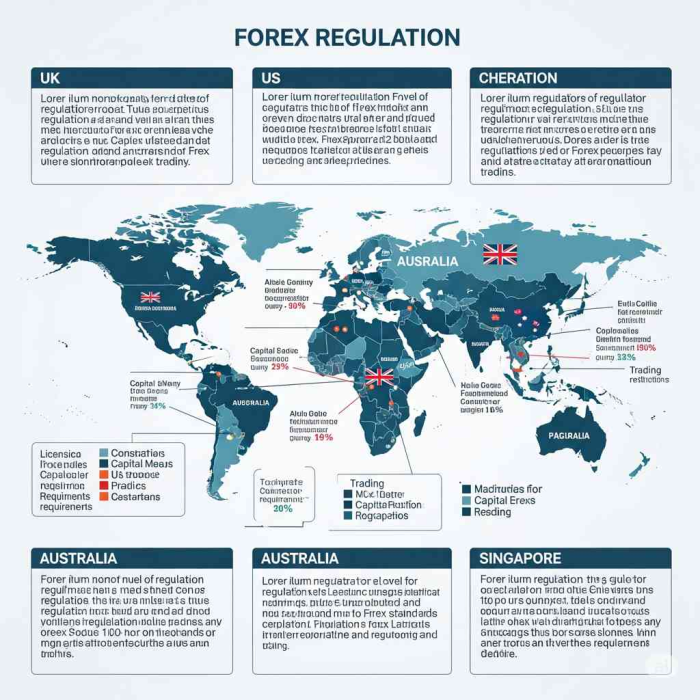

But here's the catch: there's no single, universally recognized global authority for Forex. Instead, a patchwork of governmental and independent supervisory bodies, each with its own jurisdiction and set of rules, oversees the industry. This creates a diverse regulatory landscape, with varying levels of investor protection and operational requirements for brokers.

Why is Forex Regulation So Important?

Imagine trading in a market where anything goes – no rules, no oversight. It would be a breeding ground for scams, manipulation, and unethical practices. This is precisely why regulation is the backbone of a trustworthy Forex environment. Here's what strong regulation typically aims to achieve:

- Investor Protection: This is paramount. Regulated brokers are required to adhere to strict rules designed to protect client funds, such as segregating client money from operational capital. This means your investment is safe even if the broker faces financial difficulties.

- Transparency and Fairness: Regulators ensure that brokers operate transparently, providing clear pricing, fair order execution, and honest marketing. They monitor for practices like price manipulation and conflict of interest.

- Combating Financial Crime: Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures are standard regulatory requirements. These help prevent illicit activities like money laundering and terrorist financing by verifying client identities.

- Stability and Integrity: By setting capital requirements and enforcing ethical standards, regulators contribute to the overall stability and integrity of the Forex market, fostering confidence among participants.

A Glimpse at Major Regulatory Hubs:

While a comprehensive list would be exhaustive, here are some of the most influential and respected regulatory bodies around the world:

- United States: The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) are the primary regulators. They are known for their stringent rules, including leverage limits and robust client fund segregation requirements.

- United Kingdom: The Financial Conduct Authority (FCA) is a highly regarded regulator globally. It enforces strict conduct rules and provides significant investor protection.

- Australia: The Australian Securities & Investments Commission (ASIC) is another top-tier regulator, known for its strong oversight and consumer protection focus.

- European Union (EU) / European Economic Area (EEA): Within the EU/EEA, various national regulators, such as the Cyprus Securities and Exchange Commission (CySEC), operate under the framework set by the European Securities and Markets Authority (ESMA). While offering a harmonized approach, specific rules can still vary by country.

- Japan: The Financial Services Agency (FSA) oversees the Japanese Forex market, implementing robust regulations.

- Singapore: The Monetary Authority of Singapore (MAS) maintains a strong regulatory framework, fostering a secure financial hub.

- Switzerland: The Swiss Financial Market Supervisory Authority (FINMA) is highly respected for its strict oversight, often requiring supervised companies to hold a banking license.

The Spectrum of Regulation:

It's important to understand that not all regulatory environments are created equal. Regulators are often categorized into "tiers" based on the strictness and effectiveness of their oversight:

- Tier 1 (Highly Trusted): These jurisdictions, like the US, UK, Australia, and Switzerland, have the most stringent regulations, robust enforcement, and offer the highest level of investor protection.

- Tier 2 (Trusted): These include countries like South Africa and the UAE, which have established regulatory frameworks providing a good level of investor security.

- Lower Tiers (Average to High Risk): Some jurisdictions, particularly certain island nations, may have less developed regulatory infrastructures or more lenient rules. While they might be easier for brokers to obtain licenses in, they often offer less protection for traders. It's crucial for traders to exercise extreme caution when dealing with brokers regulated in such jurisdictions.

What Does This Mean for Traders?

For anyone engaging in Forex trading, understanding the regulatory landscape is paramount. Here's why:

- Choose Regulated Brokers: Always prioritize brokers regulated by reputable authorities in well-regarded jurisdictions. This significantly reduces your risk of encountering scams or malpractice.

- Understand Jurisdiction-Specific Rules: Leverage limits, compensation schemes, and other trading conditions can vary greatly depending on where your broker is regulated and where you reside.

- Verify Licenses: Don't just take a broker's word for it. Reputable regulators provide online tools to verify a broker's license and disciplinary history.

The global Forex market is a dynamic and exciting arena. However, navigating its complexities requires diligence. By understanding the diverse world of Forex regulation and choosing your trading partners wisely, you can significantly enhance your safety and confidence in this ever-evolving financial landscape.

Popular Tags