Navigating the Digital Markets | Your Guide to Choosing the Right Trading Platform

In today's fast-paced financial world, the idea of "trading" is no longer confined to bustling exchange floors. Thanks to technological advancements, anyone with an internet connection can now participate in the global markets. The gateway to this world? Trading platforms.

But with an overwhelming array of options available, how do you choose the one that's right for you? This blog post will demystify trading platforms, highlighting their key features and offering guidance on how to pick the perfect fit for your investment journey.

What Exactly is a Trading Platform?

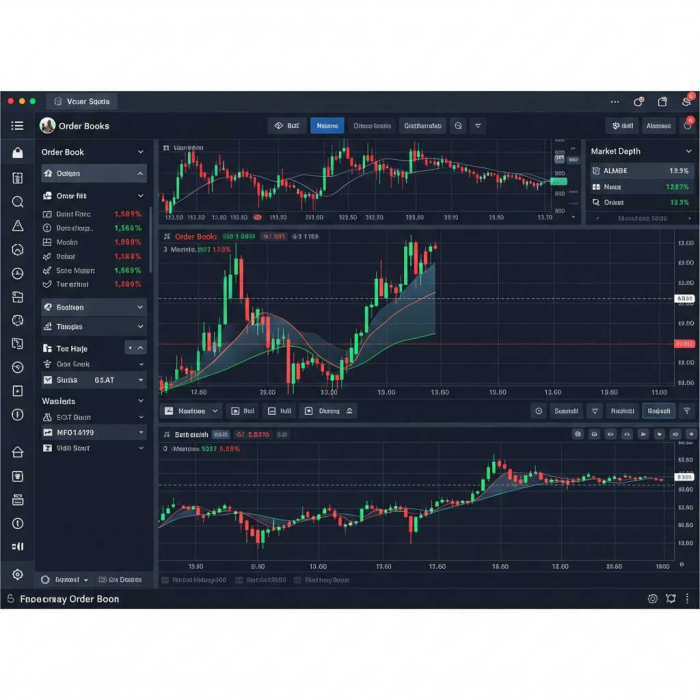

At its core, a trading platform is a software application or a web-based portal that allows investors and traders to open, close, and manage market positions. Think of it as your personal control center for buying and selling financial instruments like stocks, bonds, cryptocurrencies, forex, commodities, and ETFs. These platforms act as the intermediary between you and the financial exchanges, providing the tools and information necessary to make informed trading decisions.

Key Features to Look for in a Trading Platform

While platforms vary widely, a few essential features stand out:

-

User-Friendly Interface: Whether you're a seasoned pro or just starting, an intuitive and easy-to-navigate interface is crucial. Cluttered designs can lead to costly mistakes. Look for clean layouts, customizable dashboards, and quick access to essential tools. Many platforms offer mobile apps, allowing you to trade on the go – ensure the mobile experience is as seamless as the desktop version.

-

Asset Availability: What do you want to trade? Some platforms specialize in specific assets (e.g., crypto-only), while others offer a broad spectrum. Ensure the platform supports the financial instruments you're interested in, whether it's US stocks, international equities, options, futures, or even precious metals.

-

Fees and Costs: This is a big one. While many platforms boast "$0 commission" for certain trades, always dig deeper. Look for transparency in spreads, withdrawal fees, inactivity fees, and any other hidden charges. These costs can significantly impact your overall profitability.

-

Trading Tools and Resources:

- Real-time Data and Charts: Instant access to live market data, customizable charts with various technical indicators (like moving averages, RSI, MACD), and drawing tools are vital for analysis.

- Order Types: Beyond basic market and limit orders, advanced options like stop-loss, take-profit, and trailing stops are essential for risk management.

- Research and News: Access to analyst reports, economic calendars, and breaking news can provide valuable insights for your trading decisions.

- Backtesting Tools: For those who want to test strategies, backtesting allows you to see how a particular approach would have performed using historical data.

-

Security and Regulation: Your funds and personal data must be secure. Choose platforms regulated by reputable financial authorities (e.g., SEC, FCA, ASIC). Look for features like two-factor authentication, encryption technologies, and insurance on funds.

-

Customer Support: When you encounter an issue or have a question, prompt and helpful customer support is invaluable. Look for platforms offering multiple channels (live chat, phone, email) and readily available FAQs or knowledge bases.

-

Demo Accounts: Especially for beginners, a demo or paper trading account is a game-changer. This allows you to practice trading with virtual funds in a real-time market environment, helping you get comfortable with the platform and test strategies without risking your actual capital.

How to Choose the Right Platform for YOU

The "best" trading platform isn't a universal answer; it depends on your individual needs and trading style:

- For Beginners: Look for platforms known for their ease of use, robust educational resources, and a readily available demo account. Platforms like eToro (known for social trading and copy trading), Fidelity, Charles Schwab, and Webull are often recommended for their beginner-friendly features.

- For Active Traders: If you plan on frequent trading, prioritize platforms with fast execution speeds, advanced charting tools, algorithmic trading capabilities, and competitive fees. Interactive Brokers' Trader Workstation (TWS) or TradeStation are popular choices for experienced traders.

- For Long-Term Investors: If your focus is on long-term growth and less on active trading, platforms with a wide range of investment products (ETFs, mutual funds, bonds) and strong research capabilities might be more suitable. Fidelity and Charles Schwab are excellent in this regard.

The Bottom Line

Trading platforms are an indispensable tool for anyone venturing into the financial markets. By carefully considering your trading goals, experience level, and the features discussed above, you can confidently choose a platform that empowers you to make informed decisions and navigate the exciting world of online trading. Remember to start small, utilize demo accounts, and continuously educate yourself to build your trading skills. Happy trading!

Popular Tags