How Do Forex Signals Work? Your Guide to Smarter Trading

The world of Forex trading can seem daunting, a fast-paced environment where fortunes are made and lost in the blink of an eye. For many, especially those new to the market, the sheer volume of information and the complexity of technical analysis can be overwhelming. This is where forex signals come into play, offering a potential shortcut to identifying trading opportunities.

But what exactly are forex signals, and how do they work? Let's break it down.

What is a Forex Signal?

At its core, a forex signal is a suggestion or alert for entering a trade on a specific currency pair, usually at a particular price and time. Think of it as a tip from an experienced market observer, telling you when to buy or sell, and at what levels.

These signals typically include key information to guide your trade:

- Currency Pair: (e.g., EUR/USD, GBP/JPY)

- Direction: Buy (long) or Sell (short)

- Entry Price: The recommended price to open the trade.

- Stop-Loss (SL) Level: A pre-determined price point where you would exit the trade to limit potential losses if the market moves against you. This is crucial for risk management.

- Take-Profit (TP) Level: A pre-determined price point where you would exit the trade to lock in profits if the market moves in your favor.

How are Forex Signals Generated?

Forex signals aren't pulled out of thin air. They are the result of in-depth market analysis, performed by either human experts or sophisticated automated systems. Here are the primary methods:

-

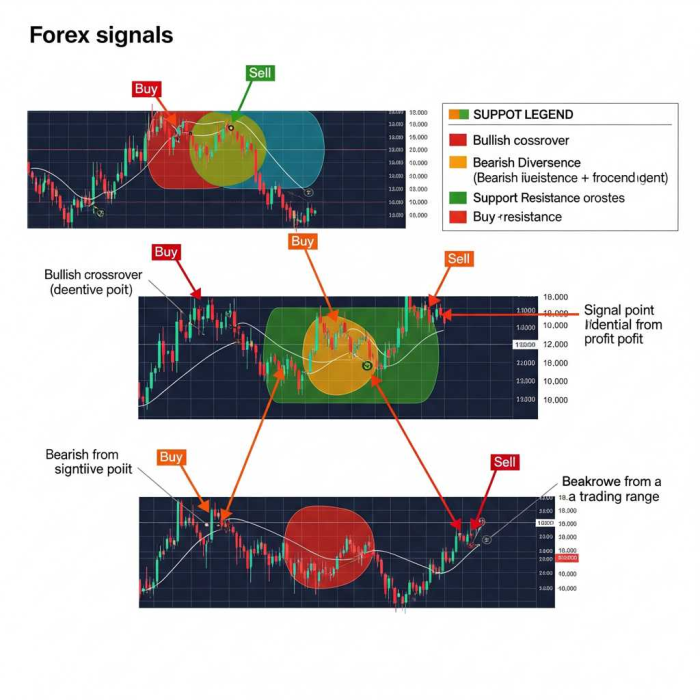

Technical Analysis: This is one of the most common approaches. Analysts or algorithms study historical price charts, looking for patterns, trends, and using various technical indicators (like Moving Averages, RSI, MACD, Bollinger Bands, etc.). The idea is that past price action can offer clues about future movements. For example, if a currency pair consistently bounces off a certain "support" level, a signal might be generated to buy when it approaches that level again.

-

Fundamental Analysis: This method focuses on economic news, geopolitical events, and financial data that can influence currency values. This includes factors like interest rate decisions by central banks, GDP reports, employment figures, inflation rates, and trade balances. A strong economic report for a country, for instance, might trigger a "buy" signal for its currency.

-

Sentiment Analysis: This involves gauging the overall mood or bias of the market towards a particular currency pair. Tools like the Commitment of Traders (COT) report can provide insights into how large institutional traders are positioned, which can sometimes indicate future price movements.

-

Automated Algorithms (Forex Robots/EAs): With advancements in technology, many signals are now generated by complex algorithms and artificial intelligence. These systems can process vast amounts of data at lightning speed, identify patterns that humans might miss, and generate signals based on predefined rules. This often allows for faster execution and can remove emotional biases from trading decisions.

How Do You Receive and Use Forex Signals?

Once a signal is generated, it needs to reach the subscriber. Common communication channels include:

- Email: Signals are sent directly to your inbox.

- SMS/WhatsApp: Quick alerts for immediate action.

- Dedicated Mobile Apps: Many signal providers have their own apps that push notifications.

- Trading Platform Integration: Some brokers offer integrated signal services directly within their trading platforms.

- Social Trading Platforms: On these platforms, you can often "copy" the trades of successful traders, which is a form of receiving signals.

Upon receiving a signal, you have two main options:

-

Manual Execution: You receive the signal and manually place the trade on your trading platform, entering the specified currency pair, direction, entry price, stop-loss, and take-profit levels. This gives you full control and allows you to use your own discretion.

-

Automated Execution: Some signal services allow for automated execution, where the signals are directly fed into your trading account, and trades are placed automatically without your manual intervention. This can be appealing for busy traders but requires a high level of trust in the signal provider.

The Benefits and Risks of Using Forex Signals

Benefits:

- Time-Saving: You don't need to spend hours analyzing charts or economic data yourself.

- Learning Tool: For beginners, signals can offer insights into how experienced traders identify opportunities and manage risk. You can learn by observing the logic behind the signals.

- Access to Expert Analysis: You can leverage the knowledge and experience of professional traders or sophisticated algorithms.

- Reduced Emotional Trading: By following pre-defined signals, you can potentially minimize impulsive or emotionally driven trading decisions.

- Increased Opportunities: Signals can highlight trading opportunities you might otherwise miss.

Risks and Considerations:

- Reliability Varies Greatly: The quality and accuracy of forex signals differ significantly between providers. Many scams exist. Always conduct thorough due diligence and look for verified performance records.

- Past Performance is Not Indicative of Future Results: Even highly accurate signals can have losing streaks. The market is dynamic and unpredictable.

- Lack of Control/Understanding: Blindly following signals without understanding the underlying analysis can be risky. If you don't know why you're entering a trade, it's harder to manage it effectively or adapt to changing market conditions.

- Costs: While some free signals exist, the most reliable and consistent services usually come with a subscription fee.

- Not Personalized: Signals are general recommendations and may not align with your individual risk tolerance, trading style, or financial goals.

- Execution Delays: Especially with manual execution, delays in receiving or acting on a signal can impact profitability in fast-moving markets.

Conclusion

Forex signals can be a valuable tool for both novice and experienced traders, offering a way to streamline analysis and identify potential trading opportunities. However, they are not a guaranteed path to riches. Success with forex signals hinges on choosing reputable providers, understanding the inherent risks, and ideally, combining them with your own learning and risk management strategies. As with any aspect of trading, continuous learning and a healthy dose of skepticism are your best allies.

Popular Tags